FTSE Russell has added Greece to its watchlist for a potential upgrade from emerging market status to developed market status. While Greek bonds have already achieved investment-grade status, this proposed upgrade specifically pertains to the country’s stock market, which remains classified as an emerging market. This shift, if approved, could have broad implications for investors, economic stability, and Greece's global financial reputation.

Background: Greece’s Market Classification Journey

FTSE Russell and MSCI are the two major index providers that influence Greece’s equity market classification. For the purposes of this analysis, we focused on MSCI, which first upgraded Greece to developed market status in 2001. However, Greece lost this status in 2013 and has since remained classified as an emerging market.

This prompts a crucial question: Does it matter? To explore this, we analyzed the performance of Greek markets under both classifications, reviewing 30 years of data to assess how market status has impacted returns.

Market Performance: Developed vs. Emerging Status

Our analysis used 30 years of data, examining the Athex General Index's performance across periods when Greece was classified as both a developed and an emerging market. The data reveals that Greece has spent 13 of these years as a developed market, experiencing both economic highs and lows, including a boom in 1999 and a downturn during the global financial crisis.

Greece has generally shown stronger overall performance when classified as an emerging market, with an average annual return of 18% during these periods. In contrast, average annual returns fell to just 3% when classified as a developed market.

While returns have been higher in the emerging market classification, they have also been accompanied by greater dispersion and volatility. This suggests that while the potential for gains is higher, the unpredictability and risk are significantly greater.

The accompanying chart illustrates the cumulative performance of the Athex General Index, highlighting how returns could have differed if one had invested exclusively during Greece’s emerging market periods.

Why Aim for Developed Market Status?

Why is there such a drive to attain developed market status despite the potential for lower returns? There are a few key motivations:

Prestige and Economic Standing: Being classified as a developed market places Greece among the world’s strongest and most stable economies, enhancing its international reputation.

Stability and Reduced Volatility: Developed markets tend to experience steadier, less volatile returns which is exactly the kind of predictability Greece seeks as it works to avoid the aggressive boom-and-bust cycles of the past.

Attracting Larger Investors: A developed market classification would likely attract long-term, institutional investors looking for stability, potentially leading to greater investment flows and economic resilience.

This analysis aligns with MSCI's findings that, while emerging markets often deliver higher returns, they are generally more unpredictable. Greece’s ambition for developed status is, therefore, a balance between attracting consistent investment and embracing more moderate growth.

Potential Impact on Greek Stock Trading: Buying and Selling Effects

If Greece is upgraded, there would be substantial buying of Greek stocks by passive index funds and ETFs that track developed market indexes. However, this effect may be offset by simultaneous selling as these same funds reduce their emerging market holdings.

To put this into perspective, MSCI currently has $832 billion in assets tracking developed market indexes, compared to $457 billion for emerging markets. Greece currently holds less than a 0.50% weight in the emerging market index. If reclassified, its weight in the developed market index would be even smaller, as it would be competing with larger economies.

Thus, while Greek stocks would see initial inflows from developed market funds, they would also face outflows from emerging market indexes. This balancing act could lead to a net-neutral flow impact overall.

Current Sentiment Among Active Managers

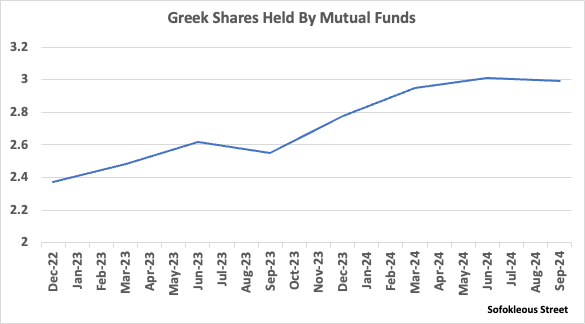

Active managers remain fairly bullish on Greece. Since September 2023, we’ve observed mutual fund managers steadily increasing their holdings in Greek shares, signaling a positive outlook on the country's economic trajectory, irrespective of market classification.

While an upgrade to developed market status could attract stable, long-term investment, it may come at the cost of reduced returns and lower volatility. Greece’s pursuit of this status reflects a desire for stability and international recognition. Whether or not it leads to a net positive effect remains to be seen, but for now, active managers seem optimistic about Greece's future.

great development, thank you for the coverage!