When I first set out to write this post, the goal was to highlight the most popular and widely held stocks among Greek fund managers, as well as those with the highest analyst coverage. However, going through the data, I noticed a recurring pattern in that the same stocks kept appearing. This led me in a different direction: the Greek market simply doesn’t have enough stocks.

That said, I don’t want to take away from the positive news: analysts are VERY bullish on Greek stocks. The Athens General Index includes 61 stocks, and of those, 38 are currently covered by research analysts. Across these, there are 328 total analyst ratings of which 268 (81%) have “Buy” ratings, while only 16 have “Sell” ratings.

In addition, analysts provide future price targets, and based on these, the average stock (that’s covered) has an upside potential of around 20% from current levels. It's worth noting that the Greek stock market is already having a great year. The table below lists all covered stocks along with their expected upside potential, and it's easy to see that most analysts are optimistic.

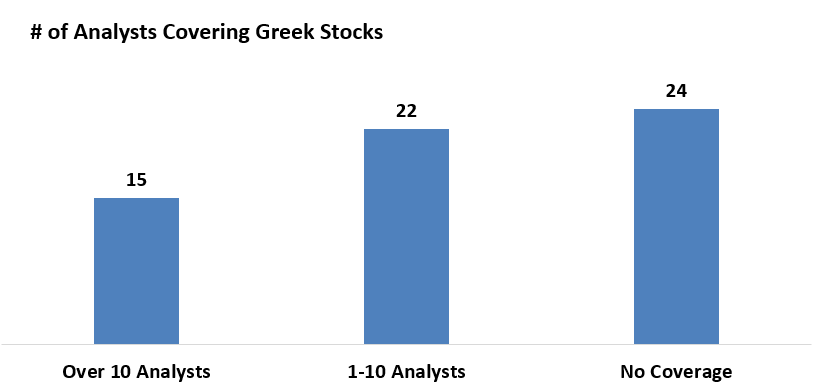

As encouraging as this sounds, the flip side is that coverage is far from complete. Out of the 61 stocks, only 37 have any analyst coverage at all. And just 22 stocks have coverage from at least five analysts and these stocks collectively represent nearly 90% of the index’s total weight.

Unsurprisingly, the most heavily covered stocks are the banks, each of which has over 20 analysts following them. These also tend to attract attention from foreign investors, not just local Greek institutions.

Meanwhile, 24 stocks have no coverage at all which is nearly 40% of the entire index. Why does this matter? The lack of coverage can create several issues. Institutional investors, index providers, and large asset allocators often want a certain level of analyst coverage before considering a stock. This creates a self-fulfilling prophecy: because only a limited number of Greek stocks have analyst coverage and as a result, capital flows primarily into these stocks, that in turn reinforces their dominance in the market.

Let’s shift the to Greek fund managers, the ones who actually pick Greek stocks. We looked at the top holdings from the 10 largest mutual funds in Greece, selecting one from each major asset manager in the country to get a broad view across firms.

Among the combined top 10 holdings of these funds, we found just 18 unique names. That alone says a lot because it’s mostly the same small pool of stocks being picked over and over. In fact, these 18 stocks collectively make up 82% of the entire Athens General Index.

The most commonly held names? Piraeus Bank and Public Power Corporation.

Active managers try to outperform the index by overweighting or underweighting these stocks. For instance, they tend to be overweight Piraeus and Eurobank, and underweight National Bank of Greece and Alpha Bank. We’ve included the full list below if you’re curious about the details.

Most held stocks by Greek Mutual Funds

But again, it all circles back to the same issue: it’s the same few names like the banks, Titan, Mytilineos, OPAP, and so on.

This isn’t really the fault of the fund managers. When you only have a handful of stocks to choose from, especially those with decent liquidity and size, there’s only so much you can do, it’s just a structural limitation of the market itself. Until there’s a broader universe of companies in Greece, active managers will keep fishing from the same small pond.

Fewer companies are going public, more are getting acquired, shrinking the pool of public companies overall. The number of stocks listed on the Athens Exchange has steadily declined, and that’s a big part of the dilemma.

So yes, Greece is a hot market right now, and capital is flowing in. But it’s disproportionately going into a handful of stocks (mostly banks) which, let’s be honest, aren’t exactly the poster children for the innovation and growth happening in the country. But that’s a post for another day.

Can you create a tradingview watchlist and share ? Would be great ... appreciating your work 🫡

Interesting insights! The Greek stock market seems to be a family business itself 😄

As far as I am aware, there aren't any Greek funds (or even European) that roll up SMBs on a national level. It has long been discussed, but perhaps HDBI (ΕΑΤΕ) should consider actively starting to search for that kind of PE managers.