Beating The Stock Market Is Hard

Most Greek Mutual Funds underperform the index

When investors talk about active versus passive investing, the difference is simple: active funds are run by professional managers who try to beat the market by picking stocks and timing trades, while passive , like ETFs simply track an index and tend to charge much lower fees. In theory, active managers should have an edge with research teams and tools at their disposal, but in practice, most struggle to outperform the market.

If you’ve been following investing for a while, you’ve probably heard the saying: “Most active managers underperform the market.” Take the SPIVA (S&P Indices Versus Active) report, which looks at how active fund managers do relative to a passive benchmark across the world and its no secret, the majority lag behind their benchmarks. Unfortunately, Greece isn’t included in SPIVA’s dataset, so we built our own version using data from the Hellenic Fund and Asset Management Association. And the story is the same.

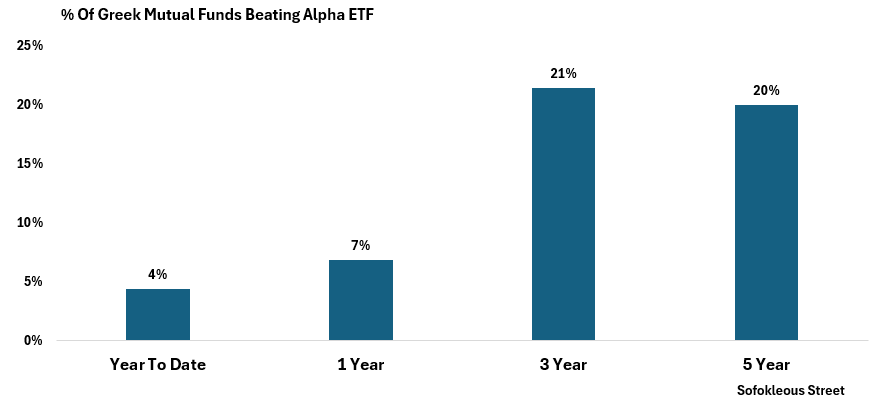

Looking across the 40+ Greek equity mutual funds, we checked returns over different horizons such year-to-date, 1-year, 3-year, and a longer 5-year. While long-term numbers look a bit better, the big picture is not good: only 20% of active funds beat a simple passive strategy like the Alpha FTSE Athex Large Cap ETF (AETF) over 5 years.

On paper, it seems odd. Professional fund managers have resources, research teams, and tools the average investor doesn’t. Shouldn’t they be able to pick winners more often? A few reasons could help explain why:

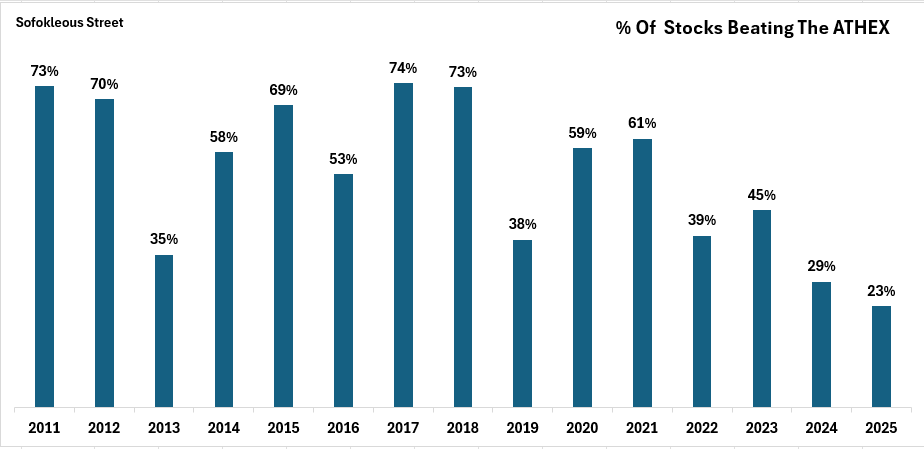

The Greek stock market isn’t that large, and the pool of stocks is shrinking. For example, the main Greek index is up over 50% this year, and most stocks are positive but only 23% are actually performing better than the index , a metric that’s been shrinking.

That means unless a a manager happened to concentrate in just a few names, the fund almost certainly lags. Active managers simply don’t have a wide enough playing field.

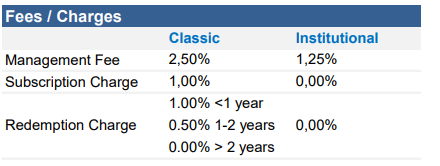

Fees are another drag. Some of the largest active funds in Greece charge as much as 2.5% annually for retail investors, while institutional classes may pay around 0.5%. Compare that with the Alpha ETF, which costs just 0.37% for everyone, the cheapest equity vehicle in Greece. When you’re paying high fees, even if the manager keeps pace with the market, your returns still trail after costs. The more layers between you and the market including brokers, platforms, managers, banks.. the less you get to keep.

We dug deeper by picking five flagship Greek equity funds, one from each of the large asset houses. Every single one lagged the ETF performance over the long term. Yet, together these 5 alone hold about €1.4 billion in total assets, while the ETF barely raised €50 million.

So, if the data is so clear and obvious, why do investors still pile money into more expensive, underperforming funds?

Distribution. Banks have a strong incentive to push their in house mutual funds, which charge higher fees and bring in revenue. ETFs and passive allocations don’t get the same attention. Not to mention this Alpha ETF is the ONLY ETF in Greece.

Complacency. Most investors simply don’t notice. After all, say your mutual fund is up 240% over five years years versus the ETF’s 273%, you might shrug and say, “I’m still doing ok.” and that attitude keeps money locked in underperforming products.

Greece still lags behind much of Europe and the U.S. in financial literacy. Greek investors check their portfolios or follow market performance far less frequently than say U.S. investors. That lack of engagement means fewer people notice the compounding drag of fees or the fact that their “good” returns could have been much better

Beating the market is hard. Greece is no exception. The stock market has been on an absolute tear over the past five years. That’s the great news. But when markets are this strong, it’s even more important to make sure you’re capturing as much of that upside as possible. If you’re stuck in a high fee mutual fund that lags the benchmark, you’re essentially leaving money on the table. Over time, those percentage points of underperformance add up to serious costs.

Great take, thank you!

P.S. Long FETA anyway for me ;)